After a conversation with Robert Wenzel of the blog EconomicPolicyJournal, I feel more confident that this may occur. I have also predicted inflation, which I also expect to see overseas first.

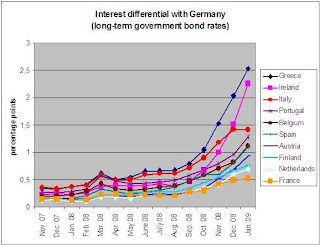

Then, I ran across this interesting chart (HT: Objectif Liberte)

Original image source here, and data here.

Original image source here, and data here.

What we see here is that the required rate of interest for these EU countries compared to Germany has been skyrocketing. In late 2007, there is little difference between the worst countries and Germany (with the lowest cost of capital). What this implies is that either these countries are all becoming worse credit risks compared to Germany or that the pool of resources available to them is dwindling.

No comments:

Post a Comment