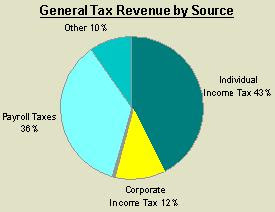

According to data from the Tax Policy Center I calculated that between 2003 and 2007 the corporate income tax totaled about 12% of all federal tax revenue. It is more volatile than other forms and ranged from a paltry 7.4% of revenues in 2003 to a high of 14.7% in 2007. Corporate profits are likely to be highly cyclical as we go through booms and busts. I created a chart to the left that shows the largest pieces of the tax revenue pie.

How High Would the Income Tax Need to Go?

On average, the revenue from the income tax would need to rise by 27% to replace the Corporate Tax. For example: The highest rate is now 35%. It would need to rise to 44.5% if a pure ratio was used. Remember, this is not a tax hike nor tax cut. I'm aiming to be revenue neutral. The people who own stock are already paying the corporate taxes.

No comments:

Post a Comment