Here on my blog and other places I have expressed concern that the housing boom that occurred before 2006 will repeat itself. I base this on the fact that few cities are doing anything to unwind their housing supply restrictions which were the cause of the high prices to begin with. Adding to this a priori analysis, when looking at historical prices there is evidence that this was actually the second boom-bust cycle for Southern California.

Bloomberg has an article suggesting that others agree with me.

California may rebound more quickly from this decline than regions with fewer delinquencies and vacant homes, according to Zandi of Moody's Economy.com. The foreclosure process is ``more efficient'' than in states such as Florida where courts are involved, and Californians are typically ``more optimistic'' about housing after experiencing busts that were followed by property booms, Zandi said.

``They know it's going to be a good investment five or 10 years down the road,'' Zandi said. ``The fundamentals are good: supply constrained markets with lots of population growth, a solid and diversified economy and important global links'' in Los Angeles and San Francisco, he said.

Just beautiful.

Thursday, July 31, 2008

Wednesday, July 30, 2008

John McCain the Radical?

John Goodman, President of the National Center for Policy Analysis, had an article in the Wall Street Journal today explanation John McCain’s Health Care plan, entitled “McCain Is the Radical on Health Reform”.

Dr. Goodman is the inventor of Health Savings Accounts, which I have been a fan of for quite some time. However, McCain’s plan does not make wider use of HSAs, taking efforts to remove some of the distortions caused by employer provided plans. His plan also removes the bias of tax treatment away from higher wealth individuals and gives everyone the exact same tax treatment. Some excerpts:

Right now the federal government encourages private health insurance primarily through the tax system -- handing out more than $200 billion in tax subsidies every year. Mr. Obama would leave this system largely intact. Mr. McCain would completely replace it with a fairer, more efficient system with a much better chance of insuring the uninsured and controlling health costs at the same time.

Under the current system, every dollar in health-insurance premiums paid by an employer is excluded from employee income and payroll taxes.

But this system is extremely arbitrary. There is virtually no tax relief for people who work for the 40% of employers who do not provide insurance, for part-time workers or people not in the labor market, or for anyone else who for any reason must buy his own insurance. The self-employed get a slightly better deal: They can deduct 100% of their premiums, but they get no relief from the payroll tax.

According to the Lewin Group, a private health-care consulting firm, families earning $100,000 a year get four times as much tax relief as families earning $25,000. In other words, the biggest subsidy goes to those who least need it, and who probably would have purchased insurance anyway.

Under the McCain plan, no longer would employers be able to buy insurance with pretax dollars. These payments would be taxable to the employee, just like wages. However, every individual would get a $2,500 credit (and every family would get $5,000) to be applied dollar-for-dollar against taxes owed.

The McCain plan does not raise taxes, nor does it lower them. Instead, it takes the existing system of tax subsidies and treats everyone alike, regardless of income or job status.

Whereas Mr. Obama would continue the current practice of giving the vast bulk of federal help to the rich (through tax subsidies) and the poor (through spending programs), the McCain tax credit would give the most new tax relief to the middle class.

Dr. Goodman is the inventor of Health Savings Accounts, which I have been a fan of for quite some time. However, McCain’s plan does not make wider use of HSAs, taking efforts to remove some of the distortions caused by employer provided plans. His plan also removes the bias of tax treatment away from higher wealth individuals and gives everyone the exact same tax treatment. Some excerpts:

Right now the federal government encourages private health insurance primarily through the tax system -- handing out more than $200 billion in tax subsidies every year. Mr. Obama would leave this system largely intact. Mr. McCain would completely replace it with a fairer, more efficient system with a much better chance of insuring the uninsured and controlling health costs at the same time.

Under the current system, every dollar in health-insurance premiums paid by an employer is excluded from employee income and payroll taxes.

But this system is extremely arbitrary. There is virtually no tax relief for people who work for the 40% of employers who do not provide insurance, for part-time workers or people not in the labor market, or for anyone else who for any reason must buy his own insurance. The self-employed get a slightly better deal: They can deduct 100% of their premiums, but they get no relief from the payroll tax.

According to the Lewin Group, a private health-care consulting firm, families earning $100,000 a year get four times as much tax relief as families earning $25,000. In other words, the biggest subsidy goes to those who least need it, and who probably would have purchased insurance anyway.

Under the McCain plan, no longer would employers be able to buy insurance with pretax dollars. These payments would be taxable to the employee, just like wages. However, every individual would get a $2,500 credit (and every family would get $5,000) to be applied dollar-for-dollar against taxes owed.

The McCain plan does not raise taxes, nor does it lower them. Instead, it takes the existing system of tax subsidies and treats everyone alike, regardless of income or job status.

Whereas Mr. Obama would continue the current practice of giving the vast bulk of federal help to the rich (through tax subsidies) and the poor (through spending programs), the McCain tax credit would give the most new tax relief to the middle class.

**********

There’s lots of good stuff in the article and if you want to read a succinct synopsis of his plan this is where to get it. If you have a question for Dr. Goodman his blog is located here.Tuesday, July 29, 2008

Housing Continues to Improve

What you will here when you read or watch the mainstream news today is that housing prices declined 16% in major markets since last year. This will be based on the new S&P Case Schiller Index numbers realeased today and available here.

What you are unlikely to hear is that the home price situation is improving and that the worst is well over. During the last year home prices on the index have shrunk every month. However, the rate at which prices are declining has begun to improve significantly in recent months. The chart below shows that rate of change.

What you are unlikely to hear is that the home price situation is improving and that the worst is well over. During the last year home prices on the index have shrunk every month. However, the rate at which prices are declining has begun to improve significantly in recent months. The chart below shows that rate of change.

It should also be noted that once again this month 7 of the 20 markets actually saw price gains. It is my opinion that 9 of the 20 markets have either hit bottom or are increasing.

Monday, July 28, 2008

The Iraq War is Over

Some politicos have been dancing around this topic for the last couple of weeks. I suggested that the war might be coming to an end earlier this month. Now I am willing to declare it:

The Iraq War is Over!

According to Icasualties.org, in the last 13 days there have been no "Hostile" American or coalition troop deaths. In this month, there have only been 7 Americans killed by hostile actions. Four others were killed by various accidents and ailments not related to attacks.

I'm not an expert on Iraq, but looking at the numbers it's hard to see how the situation can be called a war when no soldiers are dying. The number of civilian deaths still appears high, but it is becoming increasingly difficult to separate deaths from war and deaths from crime.

It will be very interesting to see how this bleeds over into the campaign.

The Iraq War is Over!

According to Icasualties.org, in the last 13 days there have been no "Hostile" American or coalition troop deaths. In this month, there have only been 7 Americans killed by hostile actions. Four others were killed by various accidents and ailments not related to attacks.

I'm not an expert on Iraq, but looking at the numbers it's hard to see how the situation can be called a war when no soldiers are dying. The number of civilian deaths still appears high, but it is becoming increasingly difficult to separate deaths from war and deaths from crime.

It will be very interesting to see how this bleeds over into the campaign.

Saturday, July 26, 2008

Thank You to Texas' Conservative Leaders

It's no secret that the price of oil has been high and it's no secret that Texas' economy has been doing well. My friend Tory Gattis' at his HoustonStrategies blog has been posting a steady stream of articles from numerous newspapers and magazines covering the "Oil Boom" in Houston. Looking at the chart below it's easy to see that states with concentrations in oil and corn production (ethanol) are doing quite well, while the rest of the U.S. is ailing.

When comparing the state to other big states the trends really jump out at you. California and Illinois have deteriorated rapidly; Texas and New York not so much. In Texas, it's hard to tell that any employment recession is happening at all.

*note - Numbers in this graphic are from the Bureau of Labor Statistics and may not jive perfectly with numbers from the Texas Workforce Commission used later.

But is oil the sole reason? Houston's economy is heavily tied to the oil industry and justly labeled the energy capital of the world. Dallas is home to plenty of oil companies and other related businesses. San Antonio too has Valero, a booming oil refining corporation. The problem with this assumption that Texas fortune is merely a coincidence of high oil prices fails when you look at the cities that don't have much oil business.

Look at Austin, El Paso, and Laredo. According to the Texas Workforce Commission Austin has an unemployment rate of 4.2%, below the state average of 4.8% and "Boomtown" Houston's 4.7%. In El Paso, which has had a higher unemployment rate than the state for many years has seen it's rate go DOWN 0.2% in the last year while the state went UP 0.2%. Laredo, has seen it's unemployment rate climb at the same rate as the state as a whole. Oil then, can not be the only explanation. Texas is fundamentally business friendly as illustrated by the this recent post.

Another explanation is that Texas was able to avoid the housing bust. As I've stated in an op-ed a while back, Texas has seen little if any housing price drops and no increase in default rates. Was this by random chance? Did evil and greedy corporations simply forget to exploit the people of Texas? Not at all. Texas had no housing boom because cities run by both Republicans and conservative Democrats never fell for many of the Urban Planning myths. We let the market make the vast majority of development decisions and allowed supply to meet demand.

Over the last decade Texas has continued to hold to a mostly free market. It has continued to be business friendly. It has continued to keep taxes low with some cuts. While not perfect, I want to applaud our state and city leaders around the state for making mostly wise decisions.

Thursday, July 24, 2008

Urban Planning's Great Leap Forward

Unfortunately, some of my fellow political and economic friends aren't aware what a serious threat to personal freedom urban planning really is. Many people don't notice or mind it because it is usually packaged with overly romanticized pictures and isn't talked about much by elite commentators. Of course, I have written before that housing supply restrictions, exacerbated by urban planning, is the only reasonable explanation for the housing crisis.

From the Wall Street Journal:

Jerry Brown's War on California Suburbs

Selected Quotes:

"In the meantime, Mr. Brown is taking aim at the suburbs, concerned about the alleged environmental damage they cause. He sees suburban houses as inefficient users of energy. He sees suburban commuters clogging the roads as wasting precious fossil fuel. And, mostly, he sees wisdom in an intricately thought-out plan to compel residents to move to city centers or, at least, to high-density developments clustered near mass transit lines.

Mr. Brown is not above using coercion to create the demographic patterns he wants. In recent months, he has threatened to file suit against municipalities that shun high-density housing in favor of building new suburban singe-family homes, on the grounds that they will pollute the environment. He is also backing controversial legislation -- Senate bill 375 -- moving through the state legislature that would restrict state highway funds to communities that refuse to adopt "smart growth" development plans. "We have to get the people from the suburbs to start coming back" to the cities, Mr. Brown told planning experts in March."

FYI - "Smart Growth" means development is centrally planned by the government.

The article isn't just about Mr. Brown, Joel Kotkin offers some other good points to rebuff the urban planners.

"Research by Mr. Modarres, co-author of the powerful book "City and Environment," demonstrates that people living in nodes -- Pasadena, Torrance, Burbank and Irvine -- often enjoy considerably shorter average commutes than do a lot of inner-city residents."

"Mr. Modarres also points out that forcing developers to build near transit lines, a strategy favored by "smart-growth advocates," does not mean residents will actually take the train or bus. A survey conducted last year by the Los Angeles Times of "transit oriented development" found that "only a small fraction of residents shunned their cars during rush hour.""

"There is also little punch behind the science used to justify the drive to resettling the cities -- and plenty of power behind the argument that suburbs are better for Mother Earth. Several prominent scholars -- including University of Maryland atmospheric scientist Konstanin Vinnikov, University of Georgia meterologist J. Marshall Shepard and Brookings Institution research analyst Andrea Sarzynski -- have found there is little evidence linking suburbanization to global warming, pointing out that density itself can produce increased auto congestion and pollution."

Great Leap Forward?

From the Wall Street Journal:

Jerry Brown's War on California Suburbs

Selected Quotes:

"In the meantime, Mr. Brown is taking aim at the suburbs, concerned about the alleged environmental damage they cause. He sees suburban houses as inefficient users of energy. He sees suburban commuters clogging the roads as wasting precious fossil fuel. And, mostly, he sees wisdom in an intricately thought-out plan to compel residents to move to city centers or, at least, to high-density developments clustered near mass transit lines.

Mr. Brown is not above using coercion to create the demographic patterns he wants. In recent months, he has threatened to file suit against municipalities that shun high-density housing in favor of building new suburban singe-family homes, on the grounds that they will pollute the environment. He is also backing controversial legislation -- Senate bill 375 -- moving through the state legislature that would restrict state highway funds to communities that refuse to adopt "smart growth" development plans. "We have to get the people from the suburbs to start coming back" to the cities, Mr. Brown told planning experts in March."

FYI - "Smart Growth" means development is centrally planned by the government.

The article isn't just about Mr. Brown, Joel Kotkin offers some other good points to rebuff the urban planners.

"Research by Mr. Modarres, co-author of the powerful book "City and Environment," demonstrates that people living in nodes -- Pasadena, Torrance, Burbank and Irvine -- often enjoy considerably shorter average commutes than do a lot of inner-city residents."

"Mr. Modarres also points out that forcing developers to build near transit lines, a strategy favored by "smart-growth advocates," does not mean residents will actually take the train or bus. A survey conducted last year by the Los Angeles Times of "transit oriented development" found that "only a small fraction of residents shunned their cars during rush hour.""

"There is also little punch behind the science used to justify the drive to resettling the cities -- and plenty of power behind the argument that suburbs are better for Mother Earth. Several prominent scholars -- including University of Maryland atmospheric scientist Konstanin Vinnikov, University of Georgia meterologist J. Marshall Shepard and Brookings Institution research analyst Andrea Sarzynski -- have found there is little evidence linking suburbanization to global warming, pointing out that density itself can produce increased auto congestion and pollution."

Great Leap Forward?

Wednesday, July 23, 2008

More Reasons for My Plan

Admidst an article by Steven Malanga at Real Clear Markets, are some good reasons to support my emphasis on ditching the corporate income tax and passing a flat tax.

On the Corporate Tax:

"Our corporate tax rate is now so high and uncompetitive that even re-destributive types like Charlie Rangel, chair of the House Ways and Means Committee, think it should be lowered. Our adjusted federal and average state corporate tax rate, at 39.27 percent, is higher than 28 out of 29 Organisation of Economic Co-operation and Development (OECD) members. In 24 states, including California, New Jersey, Massachusetts, Pennsylvania and New York, the combined federal-local tax rate is higher than in any other OECD country"

On the Income Tax:

By contrast, 24 countries around the world have now gone in the opposite direction, employing simple flat-tax schemes with no loopholes for special interests and no double taxation in the form of capital gains or estate taxes.

On the Corporate Tax:

"Our corporate tax rate is now so high and uncompetitive that even re-destributive types like Charlie Rangel, chair of the House Ways and Means Committee, think it should be lowered. Our adjusted federal and average state corporate tax rate, at 39.27 percent, is higher than 28 out of 29 Organisation of Economic Co-operation and Development (OECD) members. In 24 states, including California, New Jersey, Massachusetts, Pennsylvania and New York, the combined federal-local tax rate is higher than in any other OECD country"

On the Income Tax:

By contrast, 24 countries around the world have now gone in the opposite direction, employing simple flat-tax schemes with no loopholes for special interests and no double taxation in the form of capital gains or estate taxes.

Monday, July 21, 2008

State Rankings - Economic Freedom

The Fraser Institute, an organization located in Canada, put out a ranking of states within the U.S. and their degree of economic freedom. The full report can be found here. They also performed analysis of Canada and Mexico, which are included in the report. To simplify the report I created a graphic, which is below. The more intense the blue, the more free. The more intense the red, the less free.

The most free state, which might be hard to see, is Delaware. Texas was 2nd. On the low end, West Virginia was the worst, with Mississippi right behind. I believe that the analysis was based on data and conditions in 2005, so the rankings may have changed slightly. Some states surprised me, but it reveals no surprise as to why certain sunbelt states are booming and others are not.

The most free state, which might be hard to see, is Delaware. Texas was 2nd. On the low end, West Virginia was the worst, with Mississippi right behind. I believe that the analysis was based on data and conditions in 2005, so the rankings may have changed slightly. Some states surprised me, but it reveals no surprise as to why certain sunbelt states are booming and others are not.

*note - My stock map did not include Alaska and Hawaii. Both states ranked poorly for economic freedom.

The most free state, which might be hard to see, is Delaware. Texas was 2nd. On the low end, West Virginia was the worst, with Mississippi right behind. I believe that the analysis was based on data and conditions in 2005, so the rankings may have changed slightly. Some states surprised me, but it reveals no surprise as to why certain sunbelt states are booming and others are not.

The most free state, which might be hard to see, is Delaware. Texas was 2nd. On the low end, West Virginia was the worst, with Mississippi right behind. I believe that the analysis was based on data and conditions in 2005, so the rankings may have changed slightly. Some states surprised me, but it reveals no surprise as to why certain sunbelt states are booming and others are not.*note - My stock map did not include Alaska and Hawaii. Both states ranked poorly for economic freedom.

Friday, July 18, 2008

The Freedom Game

The plan I have detailed over the last few days may not sound revolutionary, but there is a method to my madness. If we are going to have a free market, we must trust that the government isn’t going to change the rules to benefit others over ourselves. In review, the three points are: Ban Earmarks, Enact a Flat Tax, Transfer the Corporate Tax to the Income Tax.

In economics, there is a branch of research called Game Theory. The classic example of this is the Prisoner’s Dilemma.

Looking at the table above, we have two prisoners who committed a felony, let us say armed robbery, but neither has been convicted yet, merely arrested. Both prisoners are put into separate interrogation rooms. If they both stayed silent, they could both serve 6 months in jail because the evidence is not a slam-dunk. However, the cops start to lean on them and tell them that their accomplice is starting to talk. If Prisoner B rats he goes free, and Prisoner A gets 10 years. The same is true if Prisoner A rats. If your “friend” is willing to rob a bank, how likely is it that he would not lie to stay out of prison? Both prisoners panic, and both rat on each other. Both go to prison for 5 years. This happens quite often in the real world and has been a police interrogation technique for a very long time.

We would like to think that loyalty would win out, but the consequences are just too big most of the time. When this game is repeated over and over again, the game changes, it is called a Repeated Game. Very creative right? Because the prisoners know that they are going to have to trust each other many times, they stick by their friend and don’t rat out as easily.

How does this relate to Capitalism?

While I wish that everyone could be an economist, I know this is not possible. Most who support the free market simply trust that they are being treated fairly and that people in society are receiving only the fruits of their ideas, investments, or labor. Let me reiterate an economic definition that I used on my blog a few days ago: Rent Seeking. According to Wikipedia, “In economics, rent seeking occurs when an individual, organization or firm seeks to make money by manipulating the economic and/or legal environment rather than by trade and production of wealth.” More specifically, this includes tax breaks, special contracts, welfare checks, and other special treatments.

When one group receives these kinds of rents, a.k.a. Free Money, we lose trust that we are being treated equally and envy leads other groups to seek their own rents. The best solution is to take away their rents, as I have proposed, but unfortunately, our system has made it much easier to seek rents then to remove them. It has become a game like the prisoner’s dilemma. Here is a new illustration depicting this problem.

In economics, there is a branch of research called Game Theory. The classic example of this is the Prisoner’s Dilemma.

Looking at the table above, we have two prisoners who committed a felony, let us say armed robbery, but neither has been convicted yet, merely arrested. Both prisoners are put into separate interrogation rooms. If they both stayed silent, they could both serve 6 months in jail because the evidence is not a slam-dunk. However, the cops start to lean on them and tell them that their accomplice is starting to talk. If Prisoner B rats he goes free, and Prisoner A gets 10 years. The same is true if Prisoner A rats. If your “friend” is willing to rob a bank, how likely is it that he would not lie to stay out of prison? Both prisoners panic, and both rat on each other. Both go to prison for 5 years. This happens quite often in the real world and has been a police interrogation technique for a very long time.

We would like to think that loyalty would win out, but the consequences are just too big most of the time. When this game is repeated over and over again, the game changes, it is called a Repeated Game. Very creative right? Because the prisoners know that they are going to have to trust each other many times, they stick by their friend and don’t rat out as easily.

How does this relate to Capitalism?

While I wish that everyone could be an economist, I know this is not possible. Most who support the free market simply trust that they are being treated fairly and that people in society are receiving only the fruits of their ideas, investments, or labor. Let me reiterate an economic definition that I used on my blog a few days ago: Rent Seeking. According to Wikipedia, “In economics, rent seeking occurs when an individual, organization or firm seeks to make money by manipulating the economic and/or legal environment rather than by trade and production of wealth.” More specifically, this includes tax breaks, special contracts, welfare checks, and other special treatments.

When one group receives these kinds of rents, a.k.a. Free Money, we lose trust that we are being treated equally and envy leads other groups to seek their own rents. The best solution is to take away their rents, as I have proposed, but unfortunately, our system has made it much easier to seek rents then to remove them. It has become a game like the prisoner’s dilemma. Here is a new illustration depicting this problem.

As long as rent seeking is easy, people will seek rents. As long as rents are given, we will not trust each other and we will seek our own rents. As we seek more rents, the economy will not work as well, there will be fewer jobs, and we will slowly lose our personal freedom. Getting rid of Earmarks, setting up a transparent Flat Tax, and eliminating the Corporate Tax will make rent seeking much more difficult.

Thursday, July 17, 2008

Plan Details - Flat Tax

The flat tax has been around for a while, so many people already understand it, but to avoid any confusion over what I am talking about let me reiterate. The flat tax charges a set percentage rate on income. However, most flat tax proposals only charge the flat tax rate on income above a certain amount. In my graphic below, I assume that noone would pay any tax when their income was below $20,000.

Other plans have also assumed a single deduction to account for spouses and children. I am not opposed to this and do think that something has to be done to not discriminate against married couples or singles. You may have also have noticed that my marginal tax rate is 24%. Through some research I have found flat tax plans where the marginal rate ranged from 17% to 19%. To be conservative I chose 19%. I also ratioed up the rate to account for the elimination of the corporate income tax.

Other plans have also assumed a single deduction to account for spouses and children. I am not opposed to this and do think that something has to be done to not discriminate against married couples or singles. You may have also have noticed that my marginal tax rate is 24%. Through some research I have found flat tax plans where the marginal rate ranged from 17% to 19%. To be conservative I chose 19%. I also ratioed up the rate to account for the elimination of the corporate income tax.

If some believe that the flat tax is not progressive enough, I am also not opposed to higher marginal rates on higher levels of income, but I would prefer to keep the design as simple as possible. The major point for me of creating a flat tax is to avoid showing favoritism to anyone, and closing the door on rent seeking.

Full Disclosure: I would pay significantly more federal income tax under this plan. My wife does not receive a paycheck, I have two children and a mortgage. I currently pay very little in income taxes.

Other plans have also assumed a single deduction to account for spouses and children. I am not opposed to this and do think that something has to be done to not discriminate against married couples or singles. You may have also have noticed that my marginal tax rate is 24%. Through some research I have found flat tax plans where the marginal rate ranged from 17% to 19%. To be conservative I chose 19%. I also ratioed up the rate to account for the elimination of the corporate income tax.

Other plans have also assumed a single deduction to account for spouses and children. I am not opposed to this and do think that something has to be done to not discriminate against married couples or singles. You may have also have noticed that my marginal tax rate is 24%. Through some research I have found flat tax plans where the marginal rate ranged from 17% to 19%. To be conservative I chose 19%. I also ratioed up the rate to account for the elimination of the corporate income tax.If some believe that the flat tax is not progressive enough, I am also not opposed to higher marginal rates on higher levels of income, but I would prefer to keep the design as simple as possible. The major point for me of creating a flat tax is to avoid showing favoritism to anyone, and closing the door on rent seeking.

Full Disclosure: I would pay significantly more federal income tax under this plan. My wife does not receive a paycheck, I have two children and a mortgage. I currently pay very little in income taxes.

Plan Details - Corporate Income Tax

Is Switching the Corporate Tax over to the Income Tax Feasible?

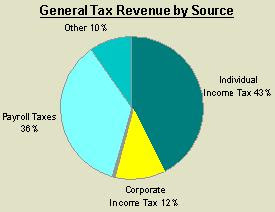

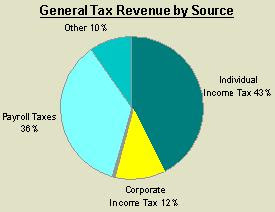

According to data from the Tax Policy Center I calculated that between 2003 and 2007 the corporate income tax totaled about 12% of all federal tax revenue. It is more volatile than other forms and ranged from a paltry 7.4% of revenues in 2003 to a high of 14.7% in 2007. Corporate profits are likely to be highly cyclical as we go through booms and busts. I created a chart to the left that shows the largest pieces of the tax revenue pie.

How High Would the Income Tax Need to Go?

On average, the revenue from the income tax would need to rise by 27% to replace the Corporate Tax. For example: The highest rate is now 35%. It would need to rise to 44.5% if a pure ratio was used. Remember, this is not a tax hike nor tax cut. I'm aiming to be revenue neutral. The people who own stock are already paying the corporate taxes.

According to data from the Tax Policy Center I calculated that between 2003 and 2007 the corporate income tax totaled about 12% of all federal tax revenue. It is more volatile than other forms and ranged from a paltry 7.4% of revenues in 2003 to a high of 14.7% in 2007. Corporate profits are likely to be highly cyclical as we go through booms and busts. I created a chart to the left that shows the largest pieces of the tax revenue pie.

How High Would the Income Tax Need to Go?

On average, the revenue from the income tax would need to rise by 27% to replace the Corporate Tax. For example: The highest rate is now 35%. It would need to rise to 44.5% if a pure ratio was used. Remember, this is not a tax hike nor tax cut. I'm aiming to be revenue neutral. The people who own stock are already paying the corporate taxes.

Tuesday, July 15, 2008

Book Review - The Law by Bastiat

I finally got around to reading Frederic Bastiat's The Law. A cogent and concise explanation of the libertarian ethic. And I do mean concise. I got through the whole book in under an hour, and I'm not a very fast reader. The version I have was translated into very accessible language. Most high school aged kids should be able to read and understand it.

Quotes:

"What, then, is law? It is the collective organization of the individual right to lawful defense."

"But there is also another tendency that is common among people. When they can, they wish to live and prosper at the expense of others."

"It is evident, then, that the proper purpose of law is to use the power of its collective force to stop this fatal tendency to plunder instead of work"

"Away with the whims of governmental administrators, their socialized projects, their centralization, their tariffs, their government schools, their state religions, their free credit, their bank monopolies, their regulations, their restrictions, their equalization by taxation, and their pious moralizations!"

Good Stuff. Especially for a Frenchman.

Quotes:

"What, then, is law? It is the collective organization of the individual right to lawful defense."

"But there is also another tendency that is common among people. When they can, they wish to live and prosper at the expense of others."

"It is evident, then, that the proper purpose of law is to use the power of its collective force to stop this fatal tendency to plunder instead of work"

"Away with the whims of governmental administrators, their socialized projects, their centralization, their tariffs, their government schools, their state religions, their free credit, their bank monopolies, their regulations, their restrictions, their equalization by taxation, and their pious moralizations!"

Good Stuff. Especially for a Frenchman.

My Platform to Revive the Republican Party

Frustration with the government has reached an all time high. Rasmussen recently released a poll that showed that the number of people who believed that Congress was doing a good or excellent job fell to a mere 9%. The lowest in the history of their polling. Neither side seems to be able to get anything done. Republicans were accomplishing very little and the Democrats seem to be biding their time hoping that this next election will give them large majorities and the White House.

The huge mistake that Republicans made when they were in power was kowtowing to special interest groups, giving unequal tax, and regulatory advantage to their supporters. The Democrats swept into power with a little idealistic fervor to change all this, but they too have succumbed to the same pressures. They let their union devotion shut down a very good trade bill with our ally in Colombia, and their anger towards “Republican” Big Oil has stopped them from easing our price problems with gasoline. Neither party has the muster to stop these bad habits.

It is not merely a problem with politicians, it is a problem with the power that we have given them. Anyone who is given a position of authority where they can help themselves, their friends or their ideology with other people’s money will be tempted to do so. This is the human condition. The only solution is to limit that authority.

Here are my 3 plans –

Ban Earmarks – Craft a bill that prevents any Congressman from submitting a bill or addition to a bill suggesting an allocation of funds to any specific organization or geographic local. A Congressman can not be bribed or cajoled to offer funds when he does not have the authority to do so. Lobbying of Congress would fall significantly.

Enact a Flat Tax – The shorter the tax code the more transparent it becomes. Having a flat tax that offers few or no deductions would stop the lobbying for special tax treatment by numerous groups. Right now the tax code punishes the new wealth accumulation at the highest tax rates, but the myriad deductions help shelter those who are trying to preserve their wealth. Lobbying of Congress to offer tax breaks for this person, but not that person would disappear.

Scrap the Corporate Income Tax – When ExxonMobil makes $40 Billion a year, their tax bill without deductions and account techniques would have been $21.5 Billion at the current 35% tax on profits. This gives a huge incentive for every corporation on earth to hire an army of accountants to cut this amount down. It also gives them a huge incentive to hire an army of lobbyists to fight for tax deductions and favorable tax accounting techniques. The income from the corporate tax should be shifted to the individual taxpayer. Wealthier individuals own more stock so their burden should be higher than those with less income so that each income group pays as close to what they already effectively pay right now. When this is done, corporate lobbying will drop precipitously.

We must take away the power of Congress to hand out money. We must take away the power of lobbyists to affect the tax code. We must take away the power of special interest groups to prosper at the expense of others. Our Congress should be focused on issues of importance not the appeasement of well-financed beggars.

The Republican Party was embarrassed out of office by too many scandals. Before we can hope to regain power and regain the public trust, we must cut off the supply of money. Legislators can not fall into corruption if they lack the power to hand out money.

Ban Earmarks, Enact a Flat Tax, and Scrap the Corporate Income Tax

The huge mistake that Republicans made when they were in power was kowtowing to special interest groups, giving unequal tax, and regulatory advantage to their supporters. The Democrats swept into power with a little idealistic fervor to change all this, but they too have succumbed to the same pressures. They let their union devotion shut down a very good trade bill with our ally in Colombia, and their anger towards “Republican” Big Oil has stopped them from easing our price problems with gasoline. Neither party has the muster to stop these bad habits.

It is not merely a problem with politicians, it is a problem with the power that we have given them. Anyone who is given a position of authority where they can help themselves, their friends or their ideology with other people’s money will be tempted to do so. This is the human condition. The only solution is to limit that authority.

Here are my 3 plans –

Ban Earmarks – Craft a bill that prevents any Congressman from submitting a bill or addition to a bill suggesting an allocation of funds to any specific organization or geographic local. A Congressman can not be bribed or cajoled to offer funds when he does not have the authority to do so. Lobbying of Congress would fall significantly.

Enact a Flat Tax – The shorter the tax code the more transparent it becomes. Having a flat tax that offers few or no deductions would stop the lobbying for special tax treatment by numerous groups. Right now the tax code punishes the new wealth accumulation at the highest tax rates, but the myriad deductions help shelter those who are trying to preserve their wealth. Lobbying of Congress to offer tax breaks for this person, but not that person would disappear.

Scrap the Corporate Income Tax – When ExxonMobil makes $40 Billion a year, their tax bill without deductions and account techniques would have been $21.5 Billion at the current 35% tax on profits. This gives a huge incentive for every corporation on earth to hire an army of accountants to cut this amount down. It also gives them a huge incentive to hire an army of lobbyists to fight for tax deductions and favorable tax accounting techniques. The income from the corporate tax should be shifted to the individual taxpayer. Wealthier individuals own more stock so their burden should be higher than those with less income so that each income group pays as close to what they already effectively pay right now. When this is done, corporate lobbying will drop precipitously.

We must take away the power of Congress to hand out money. We must take away the power of lobbyists to affect the tax code. We must take away the power of special interest groups to prosper at the expense of others. Our Congress should be focused on issues of importance not the appeasement of well-financed beggars.

The Republican Party was embarrassed out of office by too many scandals. Before we can hope to regain power and regain the public trust, we must cut off the supply of money. Legislators can not fall into corruption if they lack the power to hand out money.

Ban Earmarks, Enact a Flat Tax, and Scrap the Corporate Income Tax

Friday, July 11, 2008

Reports of Capitalism’s Demise Are Greatly Exaggerated

It has been suggested that neo-liberalism has failed because of current economic problems. It may have a black eye because of bad choices by the political party that claims it, but the Left has yet to prove that their policies at the time would have worked better or were less expensive. Let's walk back in time and remember how things were.

In 1998, I was walking on the campus of my Alma Mater, Texas A&M, where there is a tower called the Richardson Petroleum Engineering Building. In the front is a bronze statue of a roughneck working the drill floor of a rig. As I walked by, I thought to myself, “What kind of moron majors in petroleum engineering?”

At the time, oil was $11 a barrel. Besides the brief period during the first Gulf War the price had been declining since 1981. My family had lived through the oil bust in Houston during which my father was laid off several times. I knew a number of people who had to quit their oil careers and switch to something else. Houston in the ‘80s was the Detroit of today. The oil industry was dieing and the city was desperate to tout rare exceptions like Compaq Computers from the embarrassing dependence on oil companies. In the late ‘90s, oil majors were hemorrhaging losses while the rest of the country soared with the booming tech industry. Oil was still needed, but Big Oil was dead.

Back then economics professors showed how real prices for almost every commodity inevitably declined. Virtually every new power plant in the United States was going to natural gas. Hybrids and fuel cells were right around the corner. People were going to move back into the city and were going to use mass transit. Everything pointed down for the future of the oil industry.

For housing too, there were few warning signs of our recent problems. Before 2006, there had been no nationwide home price decline since the early deflationary years of the Great Depression. Since the mortgage industry came to dominate home buying, no nationwide decline had ever occurred. So, when mortgage securities, tranches, and other derivatives were created no one ever thought about the possibility of prices plunging and foreclosures exploding. We had a real estate boom during the 1970’s, but at the end, there was no bust, so why would this time be any different?

Today those on the Left are claiming victory because the free market and its proponents have failed to perform with omniscient clairvoyance, beseeching us to pitch the whole philosophy. They are taking their turns playing Monday morning quarterback with economic history to nail Republican leaders back to Ronald Reagan as responsible for today’s crises by not foreseeing the inevitability of today’s problems. The nakedness of their argument is exposed when you look at the realties a decade ago. Big Oil was ailing and mortgage backed securities were doing fine.

It would be helpful to know exactly what policies were promoted by Democrats before 2006 that would have avoided the housing crisis? Did anyone support legislation to alter the way financial service companies value mortgage backed securities? Legislation is slow and cumbersome and cannot be written to prevent a risk before the market is even aware that a problem exists. By the time errors and abuses were well known it was already too late. The only legislative prescription would have been a Luddite resistance against new financial instruments.

Similar complaints have been raised about the free market approach to the energy policy approximated by Republicans. Ten years ago, no one knew exactly when supply constraints would be a problem. Yes indeed, politicians could have gone against public sentiment and the evidence of downward trending oil prices to pass some unpopular measures and force more conservation and research on alternative fuels. However, to substantially change consumption patterns the policies would have had to have been draconian. Blithe claims that government funded alternative fuel research would have quickly found these mythic new carbon friendly energy resources are mostly wishful thinking. If we can’t produce them in high quantity at $148 oil, the research grants would have to be astronomical to be successful. Today’s higher prices are encouraging the very behaviors they would have legislated. Their policies were unpopular, unnecessary and would not have been any less painful than high gas prices.

Using the sophist argument that Republican principles are Free Market principles glosses over the broad evidence that the market is the best mechanism ever conceived to discover information and allocate resources. The correlation between free markets and high living standards is proved over and over again around the world. While free market skeptics like to cherry pick historical evidence they have still not proved that a few people can plan an economy better than individuals.

As for the morons at Texas A&M choosing to become Petroleum Engineers; they are averaging first year salaries of $78,000 a year with a bachelor’s degree. Fortunately, I was not allowed to plan their futures.

In 1998, I was walking on the campus of my Alma Mater, Texas A&M, where there is a tower called the Richardson Petroleum Engineering Building. In the front is a bronze statue of a roughneck working the drill floor of a rig. As I walked by, I thought to myself, “What kind of moron majors in petroleum engineering?”

At the time, oil was $11 a barrel. Besides the brief period during the first Gulf War the price had been declining since 1981. My family had lived through the oil bust in Houston during which my father was laid off several times. I knew a number of people who had to quit their oil careers and switch to something else. Houston in the ‘80s was the Detroit of today. The oil industry was dieing and the city was desperate to tout rare exceptions like Compaq Computers from the embarrassing dependence on oil companies. In the late ‘90s, oil majors were hemorrhaging losses while the rest of the country soared with the booming tech industry. Oil was still needed, but Big Oil was dead.

Back then economics professors showed how real prices for almost every commodity inevitably declined. Virtually every new power plant in the United States was going to natural gas. Hybrids and fuel cells were right around the corner. People were going to move back into the city and were going to use mass transit. Everything pointed down for the future of the oil industry.

For housing too, there were few warning signs of our recent problems. Before 2006, there had been no nationwide home price decline since the early deflationary years of the Great Depression. Since the mortgage industry came to dominate home buying, no nationwide decline had ever occurred. So, when mortgage securities, tranches, and other derivatives were created no one ever thought about the possibility of prices plunging and foreclosures exploding. We had a real estate boom during the 1970’s, but at the end, there was no bust, so why would this time be any different?

Today those on the Left are claiming victory because the free market and its proponents have failed to perform with omniscient clairvoyance, beseeching us to pitch the whole philosophy. They are taking their turns playing Monday morning quarterback with economic history to nail Republican leaders back to Ronald Reagan as responsible for today’s crises by not foreseeing the inevitability of today’s problems. The nakedness of their argument is exposed when you look at the realties a decade ago. Big Oil was ailing and mortgage backed securities were doing fine.

It would be helpful to know exactly what policies were promoted by Democrats before 2006 that would have avoided the housing crisis? Did anyone support legislation to alter the way financial service companies value mortgage backed securities? Legislation is slow and cumbersome and cannot be written to prevent a risk before the market is even aware that a problem exists. By the time errors and abuses were well known it was already too late. The only legislative prescription would have been a Luddite resistance against new financial instruments.

Similar complaints have been raised about the free market approach to the energy policy approximated by Republicans. Ten years ago, no one knew exactly when supply constraints would be a problem. Yes indeed, politicians could have gone against public sentiment and the evidence of downward trending oil prices to pass some unpopular measures and force more conservation and research on alternative fuels. However, to substantially change consumption patterns the policies would have had to have been draconian. Blithe claims that government funded alternative fuel research would have quickly found these mythic new carbon friendly energy resources are mostly wishful thinking. If we can’t produce them in high quantity at $148 oil, the research grants would have to be astronomical to be successful. Today’s higher prices are encouraging the very behaviors they would have legislated. Their policies were unpopular, unnecessary and would not have been any less painful than high gas prices.

Using the sophist argument that Republican principles are Free Market principles glosses over the broad evidence that the market is the best mechanism ever conceived to discover information and allocate resources. The correlation between free markets and high living standards is proved over and over again around the world. While free market skeptics like to cherry pick historical evidence they have still not proved that a few people can plan an economy better than individuals.

As for the morons at Texas A&M choosing to become Petroleum Engineers; they are averaging first year salaries of $78,000 a year with a bachelor’s degree. Fortunately, I was not allowed to plan their futures.

Thursday, July 10, 2008

Is The Iraq War Over?

From news reports resistance continues in certain areas, but the trend for U.S. troop deaths continues downward. This month so far, through 10 days, only 3 American troop deaths have been reported according to icasualties.org. This puts us on track for 9 or 10 troop deaths this month. While no deaths would be greatNearly 4 months have gone by since a British soldier has been killed (peaked last year at 12 in a month).

Update - The graph above is poorly labeled. The Y-axis should read "Deaths per day"

Monday, July 7, 2008

Sacramento, How Not to Plan a City

In the Wall Street Journal today there is a lengthy article extolling the wonderful possibilities of smart growth in Sacramento, California. The author, likely being ignorant that “Smart Growth” caused the housing crash never stops to think about the consequences of central planning.

Sacramento decided to pursue smart growth vigorously a few years back in what the author seems to imply as prescient and enlightened. Sacramento so embraced Smart Growth that the article uses this quote to describe what is happening there:

“"They're really the model," says Steve Winkelman, a transportation expert at the Center for Clean Air Policy.

I say that smart growth leaves cities vulnerable to housing market booms and busts. Who’s right?

Well, according to RadarLogic’s April RPX Monthly Housing Market Report, Sacramento, the very model of Smart Growth, has experienced the worst housing decline of any city they track in America.

Free Market - 1

Smart Growth - 0

Sacramento decided to pursue smart growth vigorously a few years back in what the author seems to imply as prescient and enlightened. Sacramento so embraced Smart Growth that the article uses this quote to describe what is happening there:

“"They're really the model," says Steve Winkelman, a transportation expert at the Center for Clean Air Policy.

I say that smart growth leaves cities vulnerable to housing market booms and busts. Who’s right?

Well, according to RadarLogic’s April RPX Monthly Housing Market Report, Sacramento, the very model of Smart Growth, has experienced the worst housing decline of any city they track in America.

Free Market - 1

Smart Growth - 0

Sunday, July 6, 2008

Is Libertarianism a Failure?

I recently ran across this commentary by Charles Wheelan, the author of Naked Economics. Entitled “Confessions of a Maturing Libertarian”, Dr. Wheelan makes a mistake that far too many economists and laymen make when it comes to the point of libertarianism and belief in the free market. From his article:

I've discovered just one problem with my elegant libertarian philosophy after spending two decades in public policy: It's terribly impractical for actually governing society. My whole quibble with libertarians can be boiled down to one banal question: What's the libertarian point of view on stoplights?

I like stoplights. More to the point, they're a simple and tangible example of how government can make us better off: They enable complete strangers to interact more safely and efficiently. Given a choice between the freedom to speed through an intersection at any time and the coercive red light, I'll tolerate the red light.

That's kind of silly, so consider a more significant example, like counterterrorism. In a world of libertarians, who finds Osama bin Laden?

Far too many libertarians believe that the market is omniscient, and too many anti-libertarian skeptics belittle it for not being so. Both sides are wrong.

By omniscient, I am speaking of the assumption by many libertarians that if only the government was eliminated all problems would go away. They embrace the power that the free market has in solving problems with religious fervor. It’s not that this viewpoint is far from the truth, but when proselytizing to a skeptical world it’s a little like quoting the Bible to Richard Dawkins. Saying “let the free market figure it out” falls on the deaf ears of non-believers.

The problem with these puritanical libertarians, and Dr. Wheelan’s understanding, is that the free market doesn’t have all the answers. The concept of the tragedy of the commons was first noted in 1833. The solution is to set up private property rights. This was fine in England where plots of land were small and stone was readily available to build fences. In the American West this was not so easy. It can be rather costly and time consuming to fence a 50,000 acre ranch. It wasn’t until the invention of cheap barbed wire that this was a viable option. Yes, the market found a solution, but the problem was apparent long before the solution came along.

In recent decades pollution has become one of the more befuddling externalities. A number of economic mechanisms have been created to reduce the negative affects it has on those uninvolved in its production. The most recent being cap and trade. The market has failed to produce a solution that eliminates the problem. A debate can be had as to the magnitude of loss that pollution produces, but I am aware of very few market solutions for it. Should we wait and let the market figure out a marketable use for soot and other pollutants? I don’t want to bet my health on it in the meantime.

Mr. Wheelan’s mistake, as with many others, is that their conversation ends here. I hold libertarianism as an ethic to strive towards in my economic analysis. Simply because there is no free market solution right now does not mean that there isn’t going to be one down the road. The market doesn’t have all the answers right now, but it is the best mechanism we have to find the answers that avoid coercion. Profit focuses our attention to solve complex problems.

I will never concede that the free market fails. It is only the limited knowledge of humanity that prevents it from finding the answer, not the failure of the mechanisms it creates. I see examples of free rider problems in the private sector all the time, from the unkempt refrigerator in the break room to community LAN space. Market “failures” are examples of bounded human knowledge not a blight on libertarianism.

I've discovered just one problem with my elegant libertarian philosophy after spending two decades in public policy: It's terribly impractical for actually governing society. My whole quibble with libertarians can be boiled down to one banal question: What's the libertarian point of view on stoplights?

I like stoplights. More to the point, they're a simple and tangible example of how government can make us better off: They enable complete strangers to interact more safely and efficiently. Given a choice between the freedom to speed through an intersection at any time and the coercive red light, I'll tolerate the red light.

That's kind of silly, so consider a more significant example, like counterterrorism. In a world of libertarians, who finds Osama bin Laden?

Far too many libertarians believe that the market is omniscient, and too many anti-libertarian skeptics belittle it for not being so. Both sides are wrong.

By omniscient, I am speaking of the assumption by many libertarians that if only the government was eliminated all problems would go away. They embrace the power that the free market has in solving problems with religious fervor. It’s not that this viewpoint is far from the truth, but when proselytizing to a skeptical world it’s a little like quoting the Bible to Richard Dawkins. Saying “let the free market figure it out” falls on the deaf ears of non-believers.

The problem with these puritanical libertarians, and Dr. Wheelan’s understanding, is that the free market doesn’t have all the answers. The concept of the tragedy of the commons was first noted in 1833. The solution is to set up private property rights. This was fine in England where plots of land were small and stone was readily available to build fences. In the American West this was not so easy. It can be rather costly and time consuming to fence a 50,000 acre ranch. It wasn’t until the invention of cheap barbed wire that this was a viable option. Yes, the market found a solution, but the problem was apparent long before the solution came along.

In recent decades pollution has become one of the more befuddling externalities. A number of economic mechanisms have been created to reduce the negative affects it has on those uninvolved in its production. The most recent being cap and trade. The market has failed to produce a solution that eliminates the problem. A debate can be had as to the magnitude of loss that pollution produces, but I am aware of very few market solutions for it. Should we wait and let the market figure out a marketable use for soot and other pollutants? I don’t want to bet my health on it in the meantime.

Mr. Wheelan’s mistake, as with many others, is that their conversation ends here. I hold libertarianism as an ethic to strive towards in my economic analysis. Simply because there is no free market solution right now does not mean that there isn’t going to be one down the road. The market doesn’t have all the answers right now, but it is the best mechanism we have to find the answers that avoid coercion. Profit focuses our attention to solve complex problems.

I will never concede that the free market fails. It is only the limited knowledge of humanity that prevents it from finding the answer, not the failure of the mechanisms it creates. I see examples of free rider problems in the private sector all the time, from the unkempt refrigerator in the break room to community LAN space. Market “failures” are examples of bounded human knowledge not a blight on libertarianism.

Tuesday, July 1, 2008

Gas Prices - A Comparison of States

Gasbuddy.com has some interesting information on gas prices including a great graphic located here. I put a smaller version on the right. The dark green equates to low gas prices, and the dark red equates with high gas prices. Because prices tend to change dramatically across state lines, I'm willing to bet that state gas taxes, regulations, and mandates are the major contributors to the differences.

South Carolina seems to have the cheapest gas, with Missouri close behind, even though they are not major oil producing or refining states. In the northeast, New Jersey seems to be an island of cheaper gas. What is really striking though is how California is solid dark red. The West Coast has dramatically higher gas prices than the rest of the U.S. In the northeast, New York and Connecticut stand out amongst the rest.

Because you can't read the key at the bottom right here is a list of select states and their average gasoline prices. Source here.

South Carolina - $3.85

Missouri - $3.85

Texas - $3.95

New Jersey - $3.97

Florida - $4.02

Massachusetts - $4.05

New York - $4.25

California - $4.59

California is paying 74 cents more than South Carolina. If your state wants to lower gas prices, they should try to not do what California is doing.

As much as I and other stereotype California's problems stemming from being more left-wing it doesn't really explain why Massachusetts isn't having such problems. Why California in particular is wracked by crisis after crisis is anyone's guess. Even when compared to other states that get ample media exposure it seems to have far more problems. Perhaps while the Northeast tends to be on the left it has more economic literacy due to it's heavy concentration of financial services.

***Update*******

Mark Perry at his Carpe Diem blog also used this graphic this morning. I suspect that we read the same article that referenced it. In addition, he has a graphic of state gas taxes. Here's the link. Gas taxes in California explain 39.7 of the 74 cent difference between California and South Carolina.

Subscribe to:

Comments (Atom)