Monday, March 30, 2009

Social Security Runs a Deficit 8 Years Early

Now, Kevin Hassett of the American Enterprise Institute, summarizes in a piece at Bloomberg, the latest Congressional Budget Office Report. The Bad News: The yearly surplus effectively hits ZERO next year. He also argues that deficits will be here from now on.

Some excerpts:

We have all been so busy whining about bonuses at American International Group Inc. and arguing about the so-called card- check legislation that we forgot to watch the Social Security surplus. While we were looking away, that surplus disappeared, eight years ahead of schedule.

...

According to the latest Congressional Budget Office estimate, the Social Security surplus will be only $3 billion in 2010. That number is almost surely too rosy, and the actual realization next year will be a big deficit. In February, according to data from the Social Security Office of the Actuary, the program paid out more in benefits than it collected in taxes and interest combined. There will be many more months like that before we are through.

...

Opponents of Social Security reform have tried for years to underplay the problem by stating that the program’s finances are fine. Social Security was, in the most recent report by its trustees, expected to run surpluses all the way to 2017. Why bother to reform something now if the crisis is so far off?

Who wants to bet that the entire surplus (which is a silly notion anyway) will no longer survive until 2041 in the next Trustee Summary?

Friday, March 27, 2009

Video of a British Evisceration

Wednesday, March 25, 2009

U.K. Having Trouble Borrowing Money

Another piece adding fuel to that theory from Bloomberg.

The U.K. failed to find enough buyers for 1.75 billion pounds ($2.55 billion) of bonds for the first time in almost seven years as debt investors repudiated Prime Minister Gordon Brown’s plan to stem the worst economic crisis in three decades.

...

Brown’s government aims to sell a record 146.4 billion pounds of debt this fiscal year and as much as 147.9 billion pounds in 2010 as he tries to pull Europe’s second-largest economy out of its worst recession since 1980. The prime minister’s plan drew criticism yesterday when Bank of England Governor Mervyn King told lawmakers in Parliament in London the government should be “cautious” about spending and deficits.

...

“This sinks Brown below the waterline,” said Bill Jones, professor of politics at Liverpool Hope University. Brown’s “whole strategy is based on borrowing and now he can’t get anyone to buy his gilts. This means the prospect of going cap in hand to the IMF hovers increasingly into view.”

This isn't a watershed moment for England, but it should raise some eyebrows given other evidence.

A Great Column on AIG

Update - Here's a great "I Quit" letter from an AIG employee published in the NY Times. (HT: Club for Growth)

Tuesday, March 24, 2009

Inflation in the U.K.

"There is no limit to how much we can do, which is why, in the end, this policy will work"

They are now considering to begin "printing money".

Then this article at Bloomberg today:

Consumer prices climbed 3.2 percent from a year earlier, the Office for National Statistics said today in London. The median forecast of 28 economists was for 2.6 percent. Bank of England Governor Mervyn King wrote in a letter to the Treasury explaining the increase from the 3 percent limit that a “sharp decline” in the inflation rate is likely to resume.

...

“It’s a big surprise,” said Stewart Robertson, an economist at Aviva Investors in London

How shocking, Mr. King, that you hold no upper bound on the money supply, yet your country experiences surprisingly higher inflation.

The article goes on to blame the drop in the value of the Pound as a reason for price hikes by foreign companies like Ford Motors. You print money and your currency loses value? What? That can't be right.

Monday, March 23, 2009

Another Day, Another Trillion

Paul Krugman writes:

The likely cost to taxpayers aside, there’s something strange going on here. By my count, this is the third time Obama administration officials have floated a scheme that is essentially a rehash of the Paulson plan, each time adding a new set of bells and whistles and claiming that they’re doing something completely different. This is starting to look obsessive.

But the real problem with this plan is that it won’t work. Yes, troubled assets may be somewhat undervalued. But the fact is that financial executives literally bet their banks on the belief that there was no housing bubble, and the related belief that unprecedented levels of household debt were no problem. They lost that bet. And no amount of financial hocus-pocus — for that is what the Geithner plan amounts to — will change that fact.

I repeat my suggestion to the President: Ask Geithner to resign.

Furthermore: Get some conservative economic advisors for balance. Your people are taking us towards the brink.

Sunday, March 22, 2009

How to Think About the AIG Bonuses

I have never received any bonus from my employer. I own no stock in any particular financial firm outside of shares included in general mutual funds. I know few specific details beyond what you can read in a newspaper.

Having said that, I think that the bill that passed the House is absolutely hurrendous. If this doesn't fall under Bill of Attainder, I don't know what does. From the outside looking in, many activities within a company or industry can seem idiotic, immoral, etc... Sometimes they are, and sometimes they aren't.

Bonuses are paid as compensation so that managment level employees care about the future of the company. If not for this kind of mechanism, an employee will often view the employer as merely a means to a paycheck. If the company fails they only face the nuisance of finding another job. Without paying some kind of retention bonus, employees would be leaving by the droves. This would leave the mess to a skeleton crew comprised of individuals who are less attractive to other potential employers. Banning retention bonuses would not have fixed anything, only made them worse. Many financial firms will fail without some of this high priced talent.

Why do they get paid so much? I don't know. I've never understood why they were paid so much. But, I also don't understand why someone would buy a $1,000 Louis Vuitton purse. Clearly someone thinks it's worth a lot or they wouldn't pay for it. Their pay may be excessive, but the general concept is a sound one that is not often understood outside of the financial services sector.

The precendent that this sort of legislation creates is an awful one. No company is safe that has any deals with the federal government. Any company can face confiscation of property based merely on political theater and not the tradition of the rule of law.

As an illustration to my brother, I used his particular industry. He works as a manager of a fast food restaurant in Oklahoma. From the outside looking in, there are certain routine acts that could be manufactured into an outrage.

I can see the headline now: "Burger company throws out thousands of pounds of food every week!" This food could go to feed the homeless, or to charge the customer less. What a bunch of wasteful and lazy people who work there!

At the company everyone is perplexed. Of course we have to throw food away. Sometimes it goes bad. Sometimes French fries get stale and burgers get burned. No one would eat them. Someone returns a burger because we missed that they requested no onions. Who wants a burger that's been rifled through by another customer. We have to throw it away. We work tirelessly to keep costs down by not throwing out food.

Our politicians and media personalities refuse to dig deeper than superficially to consider the consequences of their over-reactions. Facts don't matter, only rage in the New America. Once we cower to the mob once, the mob expects blood everymore. Let us not devolve into Jacobins.

Friday, March 20, 2009

A Note to All My Readers

If you have written something on your blog that relates to the topic of my post (for or against), feel free to write a short blurb and post a link to your post in the comments. If you see an article that relates to my post (for or against), feel free to write a short blurb and post a link to that article.

Thursday, March 19, 2009

Federal Reserve Cranks It Up a Notch

The dollar tanked yesterday and gold soared. Oil took a jump as well. These aren't definitive signs of impending inflation, but they will put upward pressure on prices. Everyone should carve out time to think about how to position themselves financially for the possibility that inflation may become a serious problem.

Also note that the metric I often use to look at inflation expectations is the spread between the TIPS and Treasury yields. If you happen to have bookmarked it, you should pay much less attention to it in the near future as the Fed is going to be directly manipulating those rates through Treasury purchases. For now, it is a bogus metric.

Tuesday, March 17, 2009

A Closer Look at Propaganda

He published a book in 1965 called "Propaganda". I haven't read this cover to cover, but I thought there were a few excerpts worth mentioning already. As news reports start to come in about fears about the resurgence of fascism in Germany and Austria, and the surge towards Statism and socialism in various countries, I thought it was worth knowing more about propaganda.

First, in the foreword, written by Konrad Kellen

"A related point, central in Ellul's thesis, is that modern propaganda cannot work without 'education'; he thus reverses the widespread notion that education is the best prophylactic against propaganda. On the contrary, he says, education, or what usually goes by that word in the modern world, is the absolute prerequisite for propaganda."

You can read the first few pages for free here. He goes on to suggest that the educated, and especially the intellectual, are most susceptible to propaganda. Once you realize that people with little education tend to just follow what their parents and community tell them, you realize that only the educated are truly open to new ideas, many of which are poorly supported.

On who falls for propaganda and why, Ellul writes (p.147-8):

"Above all he is a victim of emptiness-he is a man devoid of meaning. He is very busy, but he is emotionally empty, open to all entreaties and in search of only one thing-something to fill his inner void. To fill this void he goes tot he movies-only a very temporary remedy. He seeks some deeper and more fulfilling attraction. He is available, and ready to listen to propaganda. He is the lonely man...

He feels the most violent need to be re-integrated into a community, to have a setting, to experience ideological and affective communication. That loneliness inside the crowd is perhaps the most terrible ordeal of modern man; that loneliness in which he can share nothing, talk to nobody, and expect nothing from anybody, leads to severe personality disturbances. For it, propaganda, encompassing Human Relations, is an incomparable remedy. It corresponds to the need to share, to be a member of a community to lose oneself in a group, to embrace a collective ideology that will end loneliness. Propaganda is the true remedy for loneliness."

Is it any wonder why so many seem emotionally attached to Obama? They are psychologically driven by the story. To reject him for many is to reject meaning in their lives. How pathetic.

Sunday, March 15, 2009

Let's Privatize our Universities

However, tuition rates have been rising at a rate unpopular with many citizens. Some groups are now demanding a tuition rate cut.

This puts state universities in a tough position. The state has not increased funding commensurate with costs, and without the ability to raise revenue through tuition costs, they feel that they are not going to maintain the quality education desired. Texas A&M University, in its Vision 2020 plan, explicitly states their desire to raise revenue to enhance the stature of the university along with lip service towards better use of existing resources.

The question most legislators are looking at is whether we should allow state universities to gather more revenue, or should we try to offer a more affordable college education. The question I want to ask is – Should the state be in the university business to begin with?

The fundamental problem that prevents universities from providing a high quality education at a low cost, is the lack of the profit incentive. From top to bottom, state university officials lack the incentives to pursue an efficient allocation of resources. Their incentives are more likely aligned with expanding their budget and increasing the prestige of their individual departments.

There is also an inherent unfairness in government funding of universities in Texas. Generally speaking, Texas heavily subsidizes students who are going to be wealthy and come from homes with above average incomes. Taxes from low-income individuals are going to subsidize the education and income potential of other people’s children. The best and brightest, which are already likely to make substantial incomes, are more likely to graduate, and pursue degrees with the most associated costs as well, such as engineering.

Since our society is probably not ready to do away with all school subsidies, I'm willing to propose that Texas switch to a system of scholarships for high performing and disadvantaged students. Each university would be required through competition to attract the students and their scholarship money to their respective schools.

Going further, to assure that the universities will be forced to economize their resources, I suggest that we begin to privatize public universities across the state. Furthermore, I nominate my own alma mater, Texas A&M, to be the first. It's time to get the state out of education.

Friday, March 13, 2009

China Is Getting Wary of Lending to the U.S.

China’s Premier Wen ‘Worried’ on Safety of Treasuries

“We have lent a huge amount of money to the United States,” Wen said at a press briefing in Beijing today after the annual meeting of the legislature. “I request the U.S. to maintain its good credit, to honor its promises and to guarantee the safety of China’s assets.”

U.S. President Barack Obama is relying on China to sustain buying of Treasuries as his administration sells record amounts of debt to fund a $787 billion economic-stimulus package. Chinese investors have lost money on the securities so far this year, after increasing their holdings 46 percent to $696 billion in 2008, according to Treasury Department data.

“China’s purchases of American debt have been one of the few bolts keeping the wheels on the global economy,” said Phil Deans, a professor of international affairs at Temple University in Tokyo. “If China stops buying where does Obama’s borrowing to fund his stimulus come from?”

…

“China is worried that the U.S. may solve its problems by printing money, which will stoke inflation,” said Zhao Qingming, a Beijing-based analyst at China Construction Bank Corp., the country’s second-biggest lender. “If the U.S. can make sure this won’t happen, then China will continue to invest.”

Tuesday, March 10, 2009

Comparing Atrocities

Spanish Inquisition - perpetrated by a mainly Catholic country

Rape of Nanking - perpetrated by a mainly Taoist country

I suspect that you've heard much more about the Spanish Inquisition in school, but the "Rape" makes you think that maybe it was pretty bad too.

The Spanish Inquisition lasted from 1478 to 1834. Total Deaths: 3000-5000. Maximum average per year = 14.

Rape of Nanking lasted 2 months from late 1937 to early 1938. Total Deaths: 200,000 to 300,000. Other atrocities include the fact that "80,000 women were raped, including infants and the elderly". The savagery surpasses the worst torture in modern horror films where "The women were often then killed immediately after the rape, often through mutilation, including breasts being cut off; or stabbing by bamboo (usually very long sticks), bayonet, butcher's knife and other objects into the vagina."

Glad to see that our history education in America prioritizes atrocities by scale, and not by vendetta against a particular religion.

More on Mark-to-Market

My friend John Tamny has an article today at RealClearMarkets in defense of mark-to-market. He seems to be saying that it isn't mark-to-market that failed, but government intervention in the mortgage market that has made those assets impossible to price.

Bob Murphy linked to this blogpost that seems to agree with my position, but gets deeper into the details. Bob calls it the "definitive" post on the issue. He exaggerates, but it's still worth reading.

Second, is the fact that suspending or rescending MTM has virtually no chance of happening. Barack Obama and the Democrats could not support a bill that went against their narrative of "Government Good/Wall Street Bad". Suspending MTM would be an admission that government oversight had failed and that regulation itself was a major culprit in the banking crisis.

Sunday, March 8, 2009

Yes to Suspending Mark-to-Market

As an employee of one of these bailout blackholes, I have seen the damage to my firm from these kinds of rules. If it were not for them, I suspect that we would never have needed a single dime of government money. Companies with positive cashflow should not be going insolvent because the market value of assets that have not defaulted and they do not intend to sell have lost value.

Why is mark-to-market good?

It forces companies to report what the actual value of their securities are, and not just what they paid for them (like under book value accounting). As an analogy: Say Bob is applying for a new $2 million construction loan to build an apartment complex. He is using his existing complex, which he bought 3 years ago for $2 million as collateral. The problem is, that his old complex has been condemned by the city for health code violations. His collateral would only sell for $1 million on the open market as of today.

Corporations sometimes do the same thing. They buy assets at price X, those assets plummet to price Y, yet they report the value and solvency of the company based on a depreciation model or book value based on price X.

Why is mark-to-market bad?

When fears of corporate defaults are more random, it is fine. If it is feared that Company A will default, then companies B – Z write down any assets they held in company A. Fortunately, those losses are spread across a large number of companies. There is damage, but it isn’t that bad. Mind you, this can occur under the fear of defaults, and not actual default.

When fears of corporate defaults are widespread, it can cause a cascading effect of failures. If it is feared that companies A-I default, then J-Z have to write down those assets. Because of the large write downs by companies J-Z, fears of wider defaults grow. A vicious cycle develops, what we’ve dubbed “contagion”. A critical mass of write downs can lead to total meltdown like we’ve seen.

Using another analogy:

Imagine that you bought a house for $500,000. You had $100,000 down, so you borrowed $400,000. Imagine too that everyone in your city has done the same thing. Due to current market conditions the value of your homes fall by $200,000. Everyone in town now owes around $400,000, but has homes that are only worth $300,000.

As it is right now, the vast majority will just ride it out. They will keep paying their mortgages and prices will eventually rise over the coming years and you will all be back in the black some day. My parents did this during the Oil Bust here in Houston during the 80s.

Now, let’s assume that all home loans required mark-to-market accounting. That is, if your home lost value, you were required to post more collateral to cover the loans. Everyone in town now had to come up with $100,000 of assets to add as collateral. Anyone who failed to do so within 3 months would have their homes repossessed.

What do you think would happen to this town? As repossessions soared, prices would fall further, requiring even more assets to be posted. The town would be destroyed. Virtually no one would be able to keep their home.

In short, I think Mark-to-Market is good 95% of the time, but it creates a systemic risk during a financial slowdown. I agree with Steve Forbes, and I think there should be a 2-year suspension for most firms.

Friday, March 6, 2009

U.S. Govt Crowding Out International Borrowing

After a conversation with Robert Wenzel of the blog EconomicPolicyJournal, I feel more confident that this may occur. I have also predicted inflation, which I also expect to see overseas first.

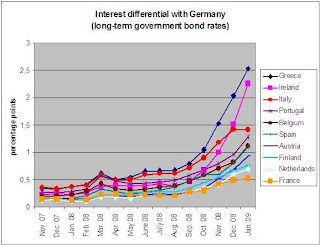

Then, I ran across this interesting chart (HT: Objectif Liberte)

Original image source here, and data here.

Original image source here, and data here.

What we see here is that the required rate of interest for these EU countries compared to Germany has been skyrocketing. In late 2007, there is little difference between the worst countries and Germany (with the lowest cost of capital). What this implies is that either these countries are all becoming worse credit risks compared to Germany or that the pool of resources available to them is dwindling.

Thursday, March 5, 2009

A Pretext for Oppression

I fight my darkest fears by trying to convince myself that this will all blow over in a few years. They will overreach and economic liberty will rise like a Phoenix from the ashes of our future years of economic malaise. I quell my worst fears because I can not see any reason that we are moving towards anything, but slightly bigger government and higher taxes.

Then, I see comments like this from Robert Reich, former U.S. Secretary of Labor under Bill Clinton:

Make no mistake: Angry right-wing populism lurks just below the surface of the terrible American economy, ready to be launched not only at Obama but also at liberals, intellectuals, gays, blacks, Jews, the mainstream media, coastal elites, crypto socialists, and any other potential target of paranoid opportunity.If someone this powerful and this influential is building the case that the opposition is filled with Nazis, where does this end?

Tuesday, March 3, 2009

Even Krugman is Criticizing the White House

First here,

And then some righteous anger about AIG's 4th bailout here:Every plan we’ve heard from Treasury amounts to the same thing — an attempt to socialize the losses while privatizing the gains. We’re going to buy up all the bad assets at premium prices; no, we’re going to offer the banks guarantees against losses; no, we’re going to let private investors buy the stuff, but offer them de facto guarantees against losses in the form of non-recourse loans.

...

And the insistence on offering the same plan over and over again, with only cosmetic changes, is itself deeply disturbing. Does Treasury not realize that all these proposals amount to the same thing? Or does it realize that, but hope that the rest of us won’t notice? That is, are they stupid, or do they think we’re stupid?

AIG is in trouble because it wrote many credit default swaps, in effect guaranteeing others against losses it lacked the resources to cover. We, the taxpayers, are now covering those losses, for fear that not doing so would cause a financial catastrophe. But this means that US taxpayers have now assumed the downside risks for all of AIG’s counterparties.My advice to Obama: Fire Geithner, the markets would soar!

In effect, then, we’ve already nationalized a large part of the financial industry’s potential losses.

So at the very least, we have a right to know who the counterparties are: who are we subsidizing, here? And beyond that, shouldn’t there be some quid pro quo? Shouldn’t the US government get something in return for taking on so much of the risk?

Monday, March 2, 2009

Will the Recession Cause a Surge in Crime?

Just eye-balling the data, it doesn't seem to correlate really strongly. The recession in the early 90's seems to match, but there doesn't seem to be a strong lagging correlation between a high unemployment rate followed by a rising murder rate.

Just eye-balling the data, it doesn't seem to correlate really strongly. The recession in the early 90's seems to match, but there doesn't seem to be a strong lagging correlation between a high unemployment rate followed by a rising murder rate.

Also, the R-squared on concurrent correlation is 28%. Using a one-year lag (how well does unemployment this year predict the murder rate next year), the correlation fell to 16%. It seems that a higher murder rate in the next year is only very weakly predicted by the data.

Notes

1. The unemployment rate is in percentages and was gather from http://www.bls.gov/. An average of the calender year unemployment rate was used.

2. The murder rate is murders/100,000 individuals.